As E-Commerce is making headways, it has become the governing force which now rules the digital world. Also, with the expansion of digitization, no one is bereft of the role it plays in each one’s life.

Each one is aware that E-Commerce gains its potency through Digitization itself; but is it so easy to step into the digital e-commerce world? The answer is ‘No’.

Setting up Marketplace can be a tough challenge for business entrepreneurs. They have to mould their Marketplace in such a way that it helps both the providers and buyers.

The major challenge which the entrepreneurs face is in providing a smooth and brisk payment transactions structure for their Marketplaces.

Let us move forth and put light into how payment structures are an imperative aspect of a marketplace.

Escrow Payment Services: Catering the Marketplaces

In the era where cyber crimes have become a common scenario, therefore when a marketplace gets complicated, it is likely that it may be prone to fraudulent activities.

Therefore marketplace owners have to make sure that all the transactions which take place through their marketplace are secure and sound.

When talking of security, what better than Escrow Payment Services which offer best payment solutions for both, small and big marketplaces.

Escrow: Providing Trust Worthy Transactions

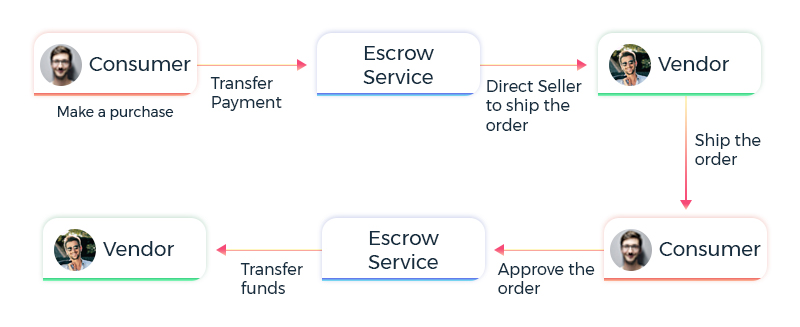

Escrow basically involves the process of “holding the funds” for the parties which are a part of a transaction. The Escrow shall release the fund only when the transaction is complete.

For instance, a buyer ‘A’ places an order and makes the payment for the same. Instead of transferring the amount directly to the seller, Escrow shall hold the payment in an escrow account.

As the buyer receives the order and finds it satisfactory in every aspect, then only will the escrow transfer the payment to the seller.

This process becomes essential when the parties are unaware of each other identities and so escrow acts as a third party platform offering trustworthy services to the supplier and the buyers.

Alibaba allows its buyers to make the payment for the order which is locked until the product is delivered to the buyer. As the buyer receives the product and confirms the order, the payment or fund is transferred to the seller.

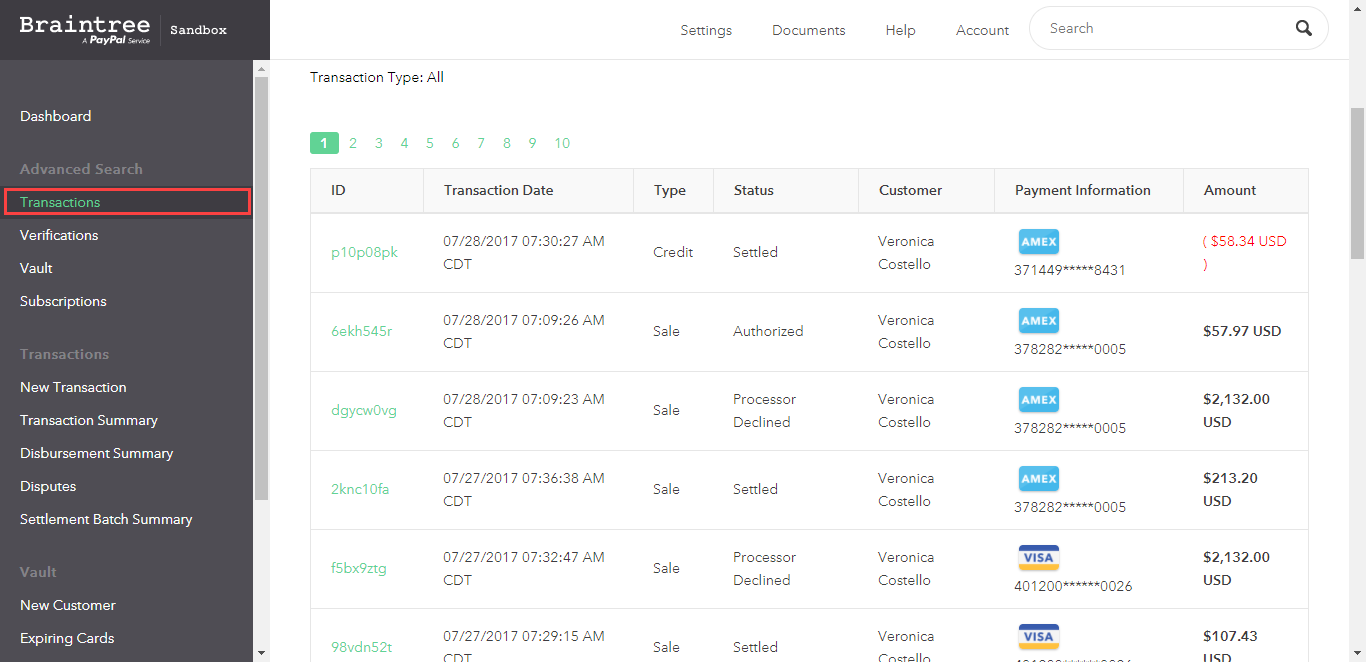

Braintree and Mangopay integrate escrow services as well.

Best for B2B Marketplaces

In B2B Marketplaces, where the buyer makes a purchase in bulk, the payments for the purchase will also be large.

Obviously, the buyers will want surety that they receive quality products for the amount they are paying as the parties may be completely unknown to each other.

The Escrow account acts as a vault which keeps the money for a time period. As the buyer receives the order, finds it satisfactory and approves it, the amount is transferred to the supplier.

For instance, if a buyer places an order for 100 LED TV’s and makes the payment to the supplier. As the buyer receives the order, he finds that the package contains 5 TV sets to be damaged.

In this case, the buyer will place a refund or a return request within a time duration let’s say 15 days as per the policy, and what if the seller refuses to pay a refund amount for the products which the buyers return.

Therefore Escrow turns out to be beneficial for the buyers who want to purchase in bulk. The payment they make, shall be safe with the escrow and as they receive the order, approves it, the escrow agent forwards it to the supplier.

Escrow: Locking Money for the Consumer’s Benefit

The basic idea behind implementing escrow services with marketplaces is to ensure that the trust and the security factor is intact amongst the seller and the buyers.

It can turn out to be useful in the following scenarios:

- When both the parties involved in a transaction are unknown to each other.

- The deal between the parties shall stretch for the long term.

- The payment amount that is to be exchanged between the parties is big.

Therefore, ensuring the integrity of the business transactions, Escrow guards the buyers against monetary loss during the transaction if in case of a faulty product or wrong product which the buyer receives.

Given below is a list of additional beneficiary factors of the Escrow Payment Services:

- Ensures the security of the payments which the buyers make for the purchase.

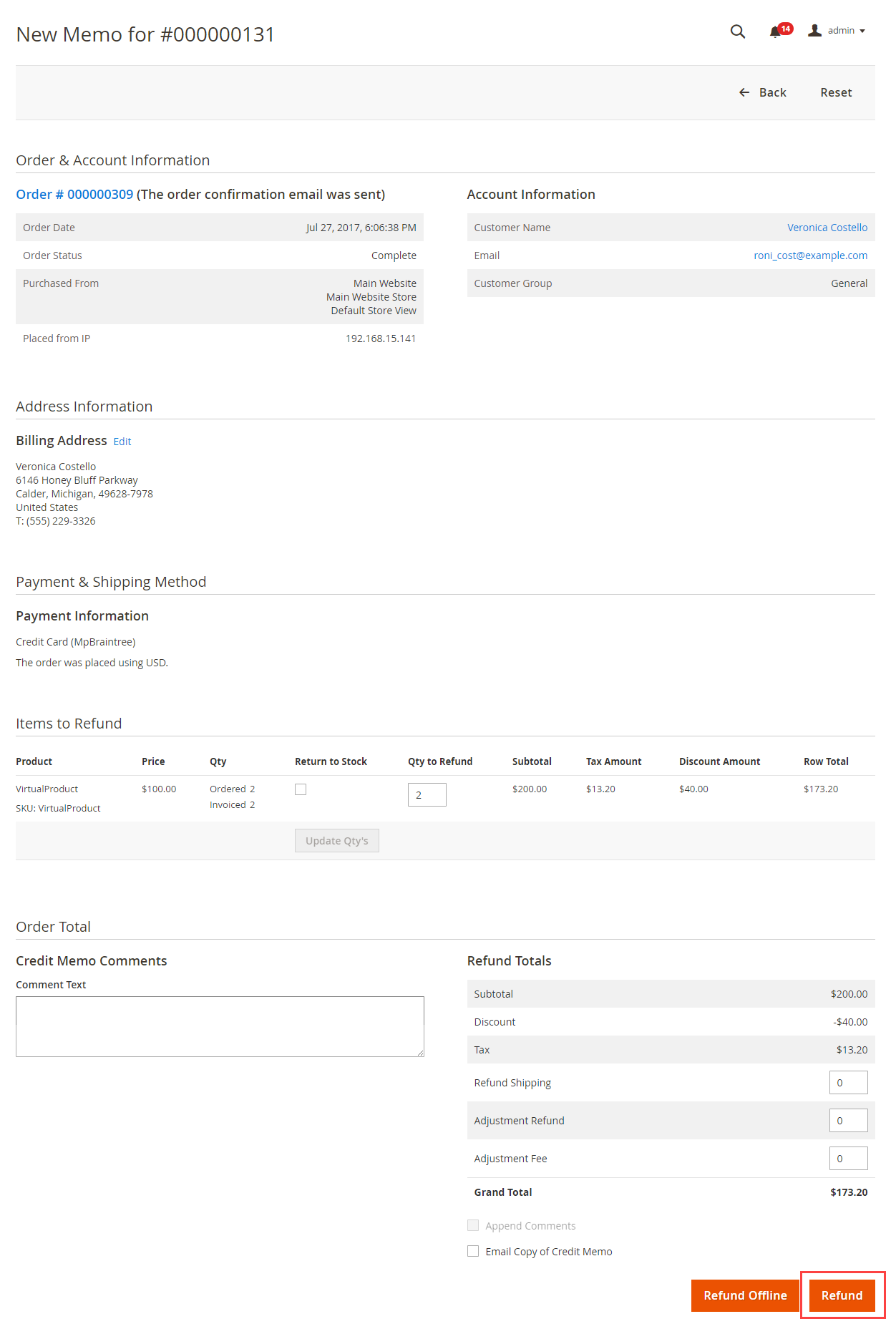

- In case the buyers do not find the product satisfactory, they may raise a refund request for the same.

- Sellers will have to ship the products to the buyers and not invest time in verifying the payment.

- Less possibility of fraud and scams which might take place while the transaction process.

- Most importantly, it maintains the transparency between the parties.

With the advancement in digitization and in the era where online data is prone to cyber-crime every now and then, it is essential for the e-commerce marketplaces to inculcate secure strategies so as to gain the customers’ trust.

That’s all for Role of Escrow Payment in E-Commerce Marketplace. If you have any issue, please feel free to add a ticket and let us know your views at https://webkul.uvdesk.com

10 comments

Greetings for the Day!

Thanks for going through the blog and dropping your query.

For now we don’t have such extension for Odoo Multi Vendor Marketplace.

However, you can drop us a mail regarding your detailed query at [email protected] so that our technical support team can look into it.

Thanks.

Greetings for the day!

Thanks for dropping by and letting us know your query.

Well, you can make use of Escrow.com instead of Mangopay and Braintree payment gateways, and the good news is, you can use Escrow.com payment gateway in almost all the countries/ regions around the globe.

Please click here to find the countries/ regions that Escrow.com supports.

Thanks and Regards!

Greetings for the day!

As of now, we do not have an Escrow Connector available for Odoo.

However, we can customize (paid service) this feature for you.

For that, you need to drop us a mail regarding your detailed requirements at [email protected] so that our technical support team can look into it and assist you over the same.

Thanks and Regards!

Does Webkul Marketplace Module integrate with Escrow.com?

Please mail us at [email protected] with your complete requirement along with the platform and we will assist you further.

Thanks.

what if buyer reports damaged goods intentionally and ask for refund? how to verify that?

how to get the ecommerce platforms to use the solution as an escrow service provider?

Greetings for the day!

Thanks for dropping by and sharing your query with us.

1) What if the buyer does not confirm even after receiving the product.

Ans) This completely depends on your business model and your business policy that implies the customers’ purchase scenario.

2) What if the buyer reports damaged goods intentionally and ask for refund? how to verify that?

Ans) Many brands like Flipkart had run a service where the delivery boy would unbox and display the product in order to check whether or not they are in a good state and functioning well. One can integrate such a feature in order to build customers’ trust and enhance the brand’s goodwill.

3) How to get the e-commerce platforms to use the solution as an escrow service provider?

Ans) Please drop us a mail at [email protected] so that we could assist your further on your query.

Thanks.